What is an FTMO and how does it work?

In the world of forex trading, aspiring traders often face challenges in obtaining the necessary capital to start a business or scale up their operations. This is where FTMO comes into play. FTMO is a proprietary trading company based in Prague, Czech Republic, founded in 2014, which provides funding to traders who demonstrate competence and consistency in their trading strategies

Introduction to FTMO

What is an FTMO?

FTMO, which stands for Funding Talent Management Organization, is an agency that funds forex traders who pass their screening process.

Here are the contacts to reach them:

- Email: support@ftmo.com

- Phone: +44 2033222983

- Address: Quadrio offices, Purkynova 2121/3, 110 00 Prague, Czech Republic

How does FTMO work?

Based on their trading performance, FTMO monitors traders in simulated environments. Traders who meet the criteria receive funding to trade in real currency, sharing profits with FTMO according to predefined terms.

FTMO Review

TrustPilot ratings show FTMO in a very positive light, with an impressive 4.8 points out of 5.0 from over 11000 reviews. This exceptional number highlights the company’s strong reputation and satisfaction among its users.

FTMO leverage explained

Definition of leverage

Leverage allows traders to control larger positions with smaller amounts of money. It includes potential gains and losses.

What leverage means for traders

Increased leverage can increase profitability, but it also increases the size of losses. Traders need to manage leverage carefully to protect their capital.

How FTMO Leverage Works

Leverage specifications provided by FTMO vary depending on the assets sold. The leverage for forex pairs, metals and indices increases to 1:100, while for commodities it increases to 1:50. Cryptocurrency trading offers leverage of up to 1:3.3, and for stocks up to 1:10. In addition, there are separate leverage limits for swing trading accounts, with leverage limits of 1:30 for forex pairs, 1:15 for metals and indices, and 1:1 for cryptocurrencies These leverage limits are designed accordingly to ensure business practices and appropriate risk ratings.

Profit sharing and FTMO

Explanation of profit split

When traders trade FTMO’s capital, they agree to share a portion of their profits with the company.

Percentage gap between FTMO and trader

Profit sharing between traders and FTMOs is defined in the clearance process. Initially, traders receive 80% of the profits, while the FTMO retains 20% of the profits. However, as traders improve and meet the terms of the scaling plan, profit sharing for traders can increase to 90%, reflecting FTMO’s commitment to rewarding successful traders This profit sharing program encourages traders to strive to remain profitable and comply with FTMO operating standards.

Different FTMO Account Types

Overview of statistics

FTMO offers accounts with different amounts and Risk management plans.

Requirements for each account

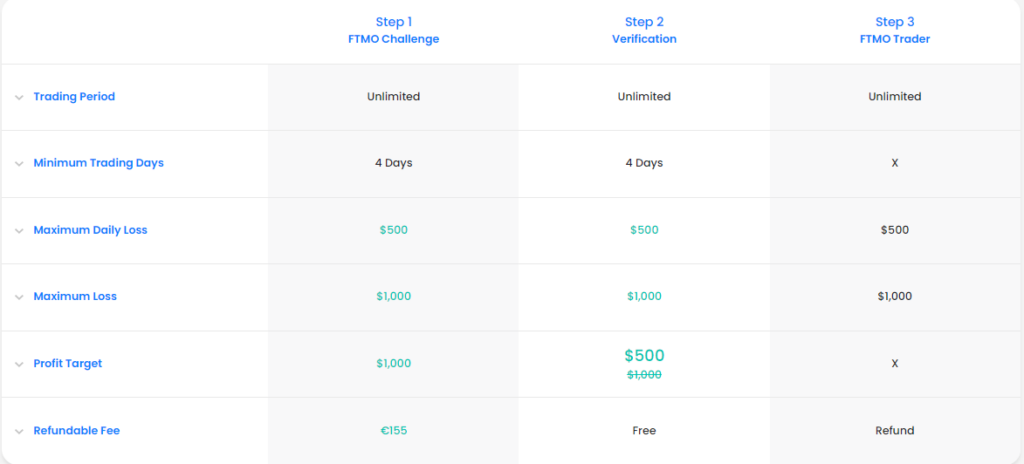

Each account has specific requirements in terms of trading experience, performance metrics (10% of the capital in first Step and 5% in second Step) and risk management (Max daily lose 5% with total Maximum Loss 10%).

Traders must meet certain criteria to pass the FTMO evaluation process, demonstrate that they are able to trade profitably and manage risk effectively.

Traders can choose the type of account that suits their trading style and goals, whether they are looking for a small amount or a larger allocation.

Pricing information on FTMO challenges

Benefits of FTMO Challenges

FTMO charges traders a fee (Challenge Fee) to participate in the research process, which includes access to their trading platform and support materials.

Payment Schedule

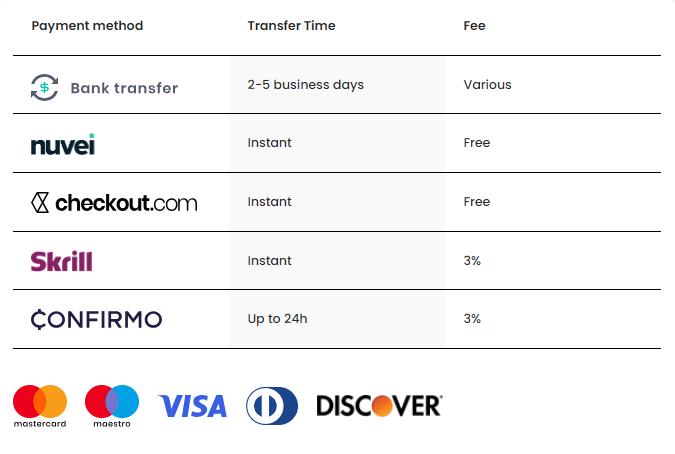

Merchants pay a one-time fee to participate in the review process. Once passed, they receive funding from the FTMO for actual marketing. He have multi payement Methods from bank transfer to Discover

FTMO Refund Policy

FTMO does not offer a refund policy for traders who fail to pass the screening process. Previously, traders were given a second chance if they did not succeed on the first attempt, but this opportunity was available only when challenges had time limits.

Clarification on FTMO’s Availability in the US

Due to regulatory restrictions, FTMO does not operate in the United States. However, the U.S. businesses from other countries can still participate in the FTMO’s review process.

National Futures Association (NFA): The NFA regulates futures trading in the US. FTMOs primarily dealing with foreign currencies (foreign currencies), which are not directly regulated by the NFA However, some forex trading programs offered by corresponding FTMO platforms may apply to futures contracts

Compatible with broker FTMO

List of Brokers supporting FTMO challenges

FTMO does not necessarily use specific groups. As a prop trading company, they provide capital and a platform for your trade, but do not act as an intermediary between you and the brokerage.

Here are the main differences:

- Broker: A financial institution that can buy and sell financial instruments such as currencies or stocks. They hold your money and link you to the market.

- FTMO: Provides funded trading accounts in which you trade their capital. They don’t hold your money or link you to a particular broker.

However, FTMO offers flexibility in your business model. You can choose from several options like MetaTrader 4, MetaTrader 5, cTrader, your own platform DXtrade. These platforms connect you with different brokers, but ultimately the broker you choose depends on the platform you choose.

conclusion

In conclusion, FTMO provides a unique opportunity for forex traders to generate finance and trade capital. By understanding how an FTMO operates, including its leverage structure, profit sharing structure, accounts, pricing, and general rules, traders can make an informed decision to participate in the FTMO’s assessment process.

FTMO FAQ :

- Is FTMO the right company?

Yes, FTMO is a formal trading company that provides finance to forex traders based on their performance. - What are the benefits of working with FTMO?

Trading with FTMO allows traders to access capital without the need for a significant upfront investment and provides support and guidance to help traders succeed. - How much leverage does FTMO offer?

The leverage provided by FTMO varies depending on the trader’s performance and contract with the company. - So the U.S. companies can participate in FTMO challenges?

No, FTMO does not operate in the United States due to legal restrictions.